Dominion Energy: A Low-Risk Winner

I grew up in Northern Virginia, which means that my home’s gas and electricity were serviced by Dominion Energy. To me, the utility servicing industry was always a bit of an enigma. In history class, I learned about the trust-busting movement during the Roosevelt and Taft administrations, and yet, it seemed like Dominion Energy was the only company around that could provide these services - at least in Virginia. It was only after reading “Enron: The Smartest Guys in the Room” that I began to understand the regulatory and operational backdrop of a very complicated energy industry.

I started looking into Dominion Energy in conjunction with a broader investment thesis that the energy industry will benefit the most from the artificial intelligence boom. At first glance, the financials are standard for any utility company:

Topline growth over the long-term

High levels of capital expenditures

Assets financed in large part by long-term debt

However, as stable as the numbers look, the company has also been operating quite inefficiently. We will get into the quantitative aspects in a moment, but Dominion’s current return on equity is significantly below what is mandated by the state. This, coupled with the growth opportunities in Virginia for both households and regulated and unregulated endpoints, provides an unparalleled opportunity for investors to invest in a blue chip with high upside potential and low downside risk.

Please note that while Dominion Energy services homes and businesses in North Carolina and South Carolina, roughly 65-70% of revenue is generated in Virginia. This report will primarily focus on the growth opportunities in Virginia.

A Very Short History of Dominion Energy

Dominion Energy, Inc. (NYSE: D) is one of the largest integrated energy utilities in the United States. Headquartered in Richmond, Virginia, the company serves about 7 million customers across 16 states, with its core operations in Virginia (~65-70% of revenue). Dominion’s business spans electric generation, transmission, and distribution, as well as natural gas infrastructure and storage:

Generation: Dominion Energy Virginia provides energy to almost 2.8 million customers with an energy generation capacity of around 30 gigawatts (GW). Generation is diversified between:

Natural Gas

Nuclear

Renewable Energy (Solar & Offshore Wind)

Transmission and Distribution: Dominion owns 6,600+ miles of transmission lines and 58,000+ miles of distribution network.

Dominion Energy in the 21st century has been highly invested in decarbonization and grid modernization, investing billions into infrastructure over the last 5 years and offloading non-core business units such as the sale of its natural gas transmission business in 2020.

Virginia’s Utility Industry

As of 2024, there are ~3.7mm housing units in the state of Virginia, of which almost all are serviced by Dominion Energy. Roughly a third of the population of Virginia lives in Northern Virginia (commonly known as NOVA), which is densely populated and has very little room for home development. Slowly, the radius of population density has been expanding outwards toward the more rural areas of Virginia; however, the rate of growth has stagnated slightly year-to-date given an unfavorable rate environment and inflationary pressures on building materials. Nevertheless, home prices remain resilient and the current lack of activity in the housing market is almost certainly due to a limited supply of listed homes (as of late 2025).

Naturally, the availability of serviceable households plays a large part in revenue growth. On the other end of the equation, when it comes to the bottom-line and profitability, utility service providers operate under a significantly different regulatory structure than other companies. The regulatory body in question is the State Corporate Commission (SCC), which derives its authority from the Virginia Electric Utility Regulation Act (VEURA). The SCC is responsible for maintaining the generation, transmission, and distribution of electricity at reasonable rates. Dominion Energy operates as a natural monopoly, which is legal for any firm that can provide a necessary good or service to the public at a lower cost by operating as a monopoly. In exchange, the SCC sets a maximum return on equity (ROE), which Dominion must stay below in order to continue operating as a natural monopoly. If Dominion exceeds the state-mandated ROE, Dominion must refund a portion of the excess earnings to the customer (generally 30-70% depending on the amount of excess earnings). Additionally, there are certain exceptions to the base rate, called rate adjustment clauses (RACs), which allows Dominion to modify billing beyond the base rate to pass-through extraneous costs. Based on the biennial review from 2023, the current ROE in Virginia is 9.7%.

The utilities regulatory framework in Virginia provides many opportunities for Dominion Energy to be a reliable source of value for its shareholders. The biennial review of the base rate provides predictability when other companies are wholly dependent on firm-specific efficiency. Predictability is also a huge benefit to the company with regards to capital investments, which are the backbone of utility service providers. Scheduled reviews of the base rate allow the company to develop 2-year cash flow forecasts to better manage capital-intensive projects. By all available evidence, Dominion should be operating significantly more efficiently than it is.

Now that we have the industry background, let’s dive into the financials.

Historical Financial Performance

Financial performance has been stable, albeit volatile. Topline has grown every year since 2021; however, growth has not been consistent and has fluctuated from 22.1% in FY22 to 0.5% in FY24. Profitability has also remained volatile, with margins fluctuating by 1500 to 2000 bps in consecutive years. Capital expenditures have grown significantly since 2021, doubling in the 4 years since. On the surface, this financial profile is not ideal for a blue-chip, Fortune 500 company; investors typically look for stability in revenue, EBITDA, and EPS in lower risk investments. It is for this very reason that Dominion Energy has gone under the radar of many investors looking to hedge their portfolios and have instead opted to purchase oil and gas stocks like Exxon or Chevron. However, the lack of consistency can be explained by several operational headwinds and corresponding responses from management that tie into the broader narrative of Dominion’s underpriced potential:

In 2020, Dominion Energy sold its natural gas transmission and storage business to Berkshire Hathaway Energy in an effort to improve its liquidity and shift the Company’s focus to a pure regulated electric and gas utilities business

In 2023, the SCC raised the ROE cap from 9.35% to 9.7%, which materially boosted revenue and profitability in 2023

Since 2023, Dominion Energy has been investing significant amounts of capex into regulated infrastructure projects, such as:

Coastal Virginia Offshore Wind (CVOW)

Grid Transformation and Security Act (GTSA) modernization programs

Renewable energy and nuclear life extension projects

The post-pandemic period of high interest rates and inflationary pressures put significant financing pressure on Dominion’s highly-levered balance sheet. This was somewhat offset by normalization of gas and power prices. In addition to reduced supply costs, Dominion improved its operational efficiency by reducing selling and administrative costs.

Due to a strong response from management in the face of significant pandemic and market volatility, Dominion maintained a strong EPS in the years following its weak 2022 financial performance. Speaking of EPS, an aspect of the company’s attractiveness as low-risk investment is its consistency in dividend payments. In 2020, the company cut its dividend from $3.45 per share to $2.52 per share as a part of a broader balance sheet repair. Since then, Dominion has kept its dividend stable rather than bring it back up to pre-restructuring levels. Since 2022, the company has kept the dividend at $2.67 per share, which equates to a yield of 4-5%. Even after the ~30% cut in 2020, this yield is higher than Dominion’s peers in the utility industry and reaffirms the company’s commitment to returning value to shareholders despite high levels of operational and financial expenses.

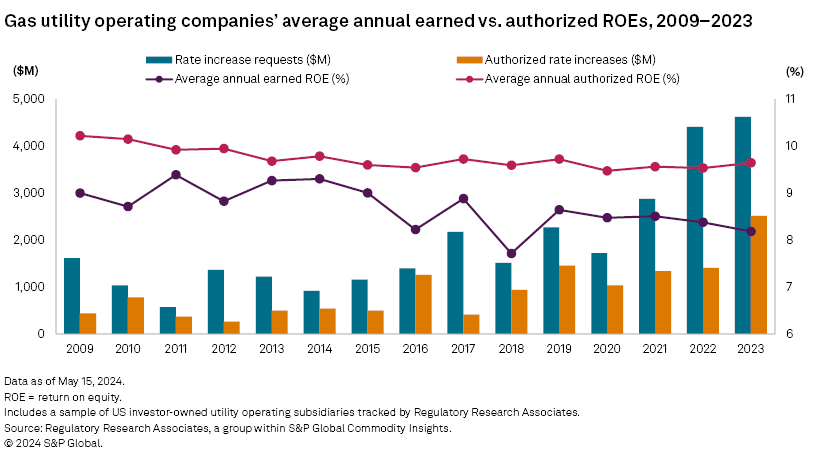

When looking at the bottom line, however, we can see the reason why the market has fundamentally mispriced the stock. As previously stated, the current ROE set by the SCC is 9.7%. While this is the maximum return on equity that Dominion is allowed to operate at, the company has not reached this target by almost 300bps every year for the last 5 fiscal years:

Why doesn’t the company operate much more efficiently than it should be, despite management’s efforts to streamline costs? The short answer is that management is unable to accurately pass on its operating and capital expenses and unexpected costs to the endpoint customer (which has demand implications in and of itself). The long answer is that Dominion Energy is in an investment phase and is forfeiting short-term value to set itself up for long-term efficiency and capital development of clean-energy assets. Dominion is front loading its capital investments during a 5-7-year period to align closer with trends in the SCC regulatory framework and utilities industry. Once the capitalized assets are eligible to be included in the SCC’s “base rate,” Dominion then enters a harvest phase, where almost all capex is maintenance not growth. From an earnings perspective, actual ROE expands closer to authorized ROE, which was closer to ~10-12% between 2015 and 2019.

Currently, Dominion Energy is nearing the end of its investment phase and is expected to start converting assets to revenue in 2026. This is consistent with the strategic decisions by management to invest in clean energy assets, improve pricing models, and effectively pass-through surge and unexpected costs. Guidance from the company seems to disregard short-term headwinds and projects power demand in the serviceable regions to double by 2039. In line with these expectations, Dominion has invested high levels of capex to improve reliability of service, shortage outage times, and add clean energy as a primary generation source.

The Investment Thesis

Near-term volatility during the investment phase caused by asset divestitures, high cost of financing, and regulatory lag has caused the market to significantly undervalue the company. Despite this, Dominion Energy has demonstrated a strong commitment to shareholder value, underscored by consistent dividend payments. Dominion is a strong investment supported by fundamental analysis of the company’s financials and go-to-market strategy. In addition, there are three growth opportunities that could significantly compound the company’s earning potential.

Growth Opportunity 1: Expansion of Northern Virginia

When I first moved to NOVA, the Washington Metro system had not yet expanded outwards into the far suburbs of Virginia and instead opted to renovate and improve service in densely populated areas of the region. Then, in 2014, the Washington Metropolitan Area Transit Authority (WMATA) opened a new line that was expected to expand outwards into the less populated areas of NOVA. The Silver Line, which originally ended in Reston, VA during the first phase and was expanded out to Ashburn, VA in the second phase, was meant to provide accessible public transit for the developing communities that were still building new homes and adding neighborhoods. Initially, the Washington Metro primarily serviced Fairfax County, which, as of 2024 estimates, is the largest county in Virginia and the 42nd largest county in the United States. However, nearby Loudoun County, where the Silver Line now ends, has outpaced Fairfax County in both absolute population growth and population density growth.

Between 2010 and 2024, Fairfax County added 82 thousand new residents to arrive at a 2024 census population of 1.2 million. This correlates to around 8% growth over the 14-year period. On the other hand, during the same period, Loudoun County added 131 thousand new residents for a 2024 estimated census population of 443 thousand. This correlates to around 42% growth over the same 14-year period, which not only makes it the fastest growing county in Virginia but among the fastest growing counties in the United States. There is one major reason why Loudoun growth significantly outpaces Fairfax growth: new housing units. There is very little available land for new real estate development in Fairfax County and any large movement in the influx or exodus of residents is generally due to supply of houses on the secondary market. However, Loudoun County is larger than Fairfax County by almost 100 square miles and has significantly more available land to develop new housing units. In fact, between 2010 and 2024, Loudoun County added 42 thousand new housing units at a growth rate of 38% during the 14-year period. On the other hand, Fairfax County only grew by 6.6% in the comparable period.

The bottom line is this: Loudoun County and surrounding counties will continue to see population outpace the rate of new housing and will therefore need to keep up development over the long-term. This provides a huge opportunity for Dominion Energy as there will be a consistent stream of new endpoint customers as long as these developing communities continue to add new housing units.

Growth Opportunity 2: Industry Shift

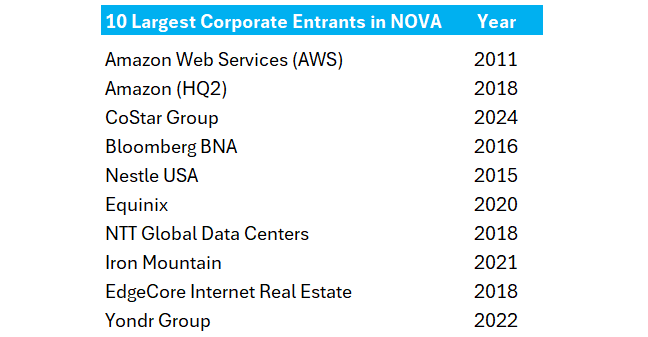

In the early 2010s, Northern Virginia was synonymous with government. Federal employees. Government consultants. Defense contractors. However, in the decade since, there has been a huge migration of technology and data-center/cloud infrastructure companies. Below are the 10 biggest companies that have opened new operations in or migrated existing operations to NOVA:

Out of the 10 ten entrants, 5 are directly related to data centers and cloud infrastructure. NOVA remains an attractive destination for data centers due to its real estate availability, abundance of businesses from all industrial backgrounds, and close proximity to Washington, D.C. The energy output from the data center growth alone is straining Dominion’s supply. There are over 275 data centers in Northern Virginia, which consumes almost 20% of the state’s total energy consumption. Small enterprise data centers can use up to 90 GWh per year, which is the same output as around 5,000 houses. Hyperscale data centers like AWS can use as much electricity as a small city. Additionally, as many growing companies look to expand operations to the East Coast, Northern Virginia will be an attractive destination due to close proximity to data centers, thereby reducing latency. It is not farfetched to imagine that NOVA may be a hub for artificial intelligence and high frequency trading in the very near future due to a strong information processing presence. On the other side of the coin, however, artificial intelligence and high performance computing can use up to 3 times more energy as cloud infrastructure and is highly reliant on an uninterrupted, high-output energy provider.

The increase in energy-heavy industries in Northern Virginia will force Dominion to invest billions into creating new plants, streamlining transmission and distribution, and reevaluate billing. Fortunately, as previously discussed, this has been part of the broader strategy during the investment phase and management has been preemptively betting on a surge of enterprise energy demand. When the wave comes, Dominion will be ready.

Growth Opportunity 3: Unregulated Operations

Energy generation and distribution in Virginia is divided into two distinct categories: regulated and unregulated.

Regulated business is the power generation, transmission, and distribution to retail customers (i.e., any resident or business that must use Dominion Energy as the only regional utility service provider) that is regulated by the SCC; the purpose of regulated utilities is to discourage price gouging by a natural monopoly

Unregulated business is any business that is sold to wholesale markets or directly to the consumer; common sources include energy trading, competitive generation, or infrastructure ventures; unregulated business is not subject to the authorized ROE

In the wake of Enron and the collapse of many oil and gas companies in the late 2000s, Dominion divested most of its unregulated assets to avoid regulatory scrutiny. However, with the emergence of clean energy and high-demand from hyperscale data centers and AI, there is room to strategically reenter the unregulated market. How can Dominion Energy ethically and profitably take advantage of the unsuspecting exceptions in SCC regulations?

-

Hyperscale data centers like Amazon Web Services are looking for tailored power solutions that fall outside of the normal framework of regulated business. For example, companies are increasingly seeking out renewable energy in an effort to meet net-zero emission requirements. Bilateral power purchase agreements (PPAs) remediate this very issue. Dominion is not subject to the ROE for these agreements, while the purchaser can negotiate renewable-only energy or carbon neutral guarantees. Both parties benefit and, based on the growth of energy-guzzling tech giants in Northern Virginia, there will not be a lack of demand for customized power solutions.

-

Large energy companies like NextEra have dedicated unrestricted subsidiaries with the purpose of selling energy to whole sale markets in other geographies. Joint ventures or development arms are ways to strategically circumnavigate SCC jurisdiction and diversify Dominion’s servicing portfolio to different regions.

-

Certain customers require near-perfect power reliability, as even brief outages can disrupt operations or damage equipment. As a result, energy storage is central to grid management and a key offering for data centers and manufacturers. By strategically deploying battery systems outside load centers or industrial sites, Dominion can provide hedges against demand surges, reduce peak loads, and improve regional grid stability. Energy storage can also provide capacity and reliability support to regional grids via regional transmission organizations (RTOs), complementing other utilities in densely populated areas.

The purpose of diversifying into unregulated business isn’t to avoid the authorized ROE; regardless of the potential of the unregulated segments, the majority of Dominion’s growth and stability will be in the core, retail energy business. However, the unregulated segment can explore untapped markets by building on the company’s history of reliability and unparalleled service while providing an additional margin bump to the company’s bottom line.

Final Thoughts

Dominion Energy is a diamond in the rough, undervalued and forgotten by the market as a bygone in a rapidly evolving world. What the market fails to realize is that Dominion is not only the starting point for these artificial intelligence and data center companies, providing the large quantities of energy required to keep these industries afloat, but services a region with the ability to attract tech giants. Having recognized this trend years ago, Dominion Energy has quietly invested billions into developing its power generation capabilities and renewable energy infrastructure and starting in 2026, will emerge an industry leader in a rapidly growing region.

References

Dominion Energy — “Press release: Dominion Energy Agrees to Sell Gas Transmission & Storage Assets to Berkshire Hathaway Energy” (Jul 5, 2020). Announces $9.7B transaction and strategic refocus.

BusinessWire — “Berkshire Hathaway Energy Completes Acquisition…” (Nov 2, 2020). Coverage of closing steps and timing.

Dominion Energy — 2024 Annual Report / “Delivering On Our Plan” (2024/2025 corporate annual report). Company summary of operating footprint (3.6M regulated customers), capex plans and strategic priorities.

SEC / Dominion Energy — Form 10-K / FY2024 filing (SEC archives). Legal & financial disclosures, segment & geographic discussion.

Virginia State Corporation Commission — “Implementation of the Virginia Electric Utility Regulation Act” (SCC implementation memo / report; November 2023). Notes ROE of 9.7% for the 2023 biennial review and roll-in of RACs.

Virginia Code — Virginia Electric Utility Regulation Act (text / statutory provisions on SCC authority).

Dominion Energy — Coastal Virginia Offshore Wind (CVOW) project page (project description, 2.6 GW, 176 turbines, jobs/benefits).

Reuters — “Dominion partners with Stonepeak to fund Virginia offshore wind farm construction” (Feb 22, 2024). Reporting on Stonepeak partnership / financing of CVOW.

Dominion Energy — Grid Transformation and Security Act (GTSA) / Grid transformation plan documents. (Dominion filings and GTSA annual reports describing modernization programs).

Loudoun County Office of Management & Budget — “Housing Unit Estimates 2000–2024 (2024 estimate series).” Shows 2010 = 109,442 units, 2024 ≈ 150,656 units (Loudoun OMB table).

Fairfax County — Demographic Reports (2024 / full report and archival 2010 tables). County tables for population, households and housing units.

HAND / Housing Indicator Tool — Fairfax & Loudoun jurisdiction pages (summary production and housing-unit additions). Useful for year-over-year housing production metrics.

JLARC (Virginia Joint Legislative Audit & Review Commission) — “Virginia Data Centers” study / December 2024 report (PDF). Documents data-center growth, energy impacts, and policy implications for Virginia’s grid.

VPM / local reporting on JLARC findings (Dec 2024 coverage of data-center energy demand). Helpful local coverage summarizing JLARC conclusions.

Reuters / climate & energy reporting — Dominion solar approvals & related rate/energy coverage (e.g., April 2024 story on SCC approvals).

Dominion Investor Relations — Dividends & Splits historical page (dividend history / current declared levels).

Secondary reporting & analysis (context on data-center energy demand and forecasts): Financial Times, Reuters, AP — for broader context on data-center energy forecasts and Virginia’s position as a global market hub.